Cloud System support us as a featured Service Provider ww2ww

Evershine provides the Services supported Cloud System, designed by our in-house IT Team.

Supported by Web Platform

Our web-platform was designed in-house in order to provide our Afford online accounting services to WFOE clients in Taiwan, China, France, and other countries across the globe.

Our clients obtain all our Afford online accounting services via unique access to our world-class web-platform.

What is our web-platform?

We implement computer servers located in an Internet Data Center with our proprietary financial control authorization system.

In order to safeguard information security, we use RSA server with a one-time password e-token to strictly authenticate the access of every user.

Our client users can safely access our web-platform to key in, update, query, or get real-time financial reports anytime and anywhere.

There are more than 14 modules on our web-platform.

Each one can be integrated with a large online banking system as well as with a well-known ERP.

In order to match the needs of different language users, our web-platform now can be offered in English, Traditional Chinese, Simplified Chinese, and Francese.

Through support from the web platform, our Afford online accounting service has three features:

1. Hassle-free

When using our Afford online accounting services, your Asia operation can be easily set up.

You don’t need to bother about tax or labor regulation compliance.

2. Seamless-collaboration

Your subsidiary staff, parent company staff, and Evershine staff, all three parties can seamlessly collaborate with one another.

All processes and documentation are updated immediately and can be accessed in real-time for each authorized party.

3. Fraud-proof

Our web-platform can be linked with local banking online authorization system functions.

Only petty cash will be kept in your local office, any other payments can be approved remotely and be wired out directly without passing through the local cashier.

How many systems does the whole version consist of?

1) Web-based Account Payable (A/P) Authorization System

2) Web-based Account Receivable (A/R) Authorization

3) General Ledger & Reporting Web-based System

4) Human-BPO Web-based Payroll Authorization System

5) Payroll Calculation System

6) Selling-Inventory Authorization System

7) Purchasing-Inventory Authorization System

8 ) Client Credit Check System

9) Inventory Costing System

10) Budgeting Control Web-based System

11) Fixed Asset Management System

12) Miscellaneous & General Purchase Authorization System

13) Proposal Authorization System

14) Tailor-Made OA Authorization System

Design Principles

Collaborative platform must be a web-based version

The only web-based platform could support a collaborative process among different office locations and among client staff and Evershine staff.

Security measures must be based on each online user

Collaborative web-platform considers each online user as a security unit.

Data processing like key-in, updating, or queries all are based on each online user as a security unit.

That means one online user can not see the information that belongs to another online user.

Web-platform needs to support online operation

A collaborative web-platform must allow the person involved in a transaction to key in or update the correct information at the time the transaction happened and at the location it occurred.

In addition, that document must be reviewed and authorized by the relevant person.

After being approved, the information must be passed through the next workflow to be picked up.

The revision of a once approved document needed to use another form.

Once a form document has been approved, if someone would like to revise the content of that document, he/she needs to use another form.

The original cannot be overwritten directly without leaving a track record.

Information security measures must be secure and safe

Now that the collaborative web-platforms are built on the Internet, information security needed to be very secure and safe. Therefore, user personal identification, encryption when transmitting data on the Internet, database back-up and disaster recovery, etc must be adopted.

The approved up-flow document must become part of the to-do list of the next flow process

Once an up-flow document has been approved, it must become part of the to-do list of the next workflow.

This means when making a next-flow document, one can pick up the data information from approved last-flow documents.

This would avoid double key-in, double review and double-checking.

The data flow can be accessed, amended, and processed from the beginning to the end.

Data files produced by the web-based platforms can be uploaded into a web-based banking authorization system.

After an applicant sends out a form, it must be reviewed or approved by the authorized person assigned by the client.

It can be reviewed or approved anywhere and anytime.

Security measures of the collaborative web-based platform

*Cluster-Mirror Backup.

*RSA OTP (One-Time-Password) Personal Identification Certification.

*Internet Data Center Chung-Hua Telecom IDC center is where our servers are located.

*Geo-Trust Encoding Data Package allows Internet communication process with encryption.

*Financial statement & Managerial Report would be gotten through the firewall with fixed IP to Fixed IP address.

*Server IP address does not open for Internet searching like Google or MSN or Yahoo.

*7-level Data Security protection Measures.

Integrated with well known web-banking systems

Evershine’s platform can upload its files to several corporate web-banking systems

Business version users of these web-banking systems are rather secure and safe.

It is not like the personal version which allows only one person to wire money to another bank account.

The business version requires three roles to make a payment process.

The three roles are composed of “maker”, ”reviewer” and “approver”.

An integrated web-banking system with Evershine collaborative platform:

Taiwan Area

China Trust Bank; E. Sun Bank; Chang Hwa Bank

First Bank; Hua Nan Bank; Taiwan Bank; HSBC

Mainland China Area

China Bank; China Commercial Bank; China Construction Bank

France Area

Mitsui Bank

Three groups in four different languages

Evershine platforms are composed of three groups in four different languages

Composed of three groups

The first group is a web-based financial control system which includes an accounts payable web-based authorization system, accounts receivable web-based authorization system and a journal entries web-based authorization system.

The second group is a web-based general ledger authorization system that includes various financial statements.

The third group is a web-based buy-and-sell module which includes an inventory-purchasing system, inventory-selling system and an inventory system.

Support different language versions

The web-based financial control system can be shown in two languages at the same time.

There are three groups:

English with Traditional Chinese,

English with Simplified Chinese,

English with Francese.

The web-based general ledger system and the web-based buy-and-sell module can use one of 4 languages at one time. Languages that are available are:

English, Traditional Chinese, Simplified Chinese and Francese.

Hassle-free services

Our services are accessible as long as you are based in Asia and have access to the Internet.

Your staff can use our web-platform with only 1 to 2 hours of training.

The entire accounting and payroll system could be implemented within a week.

Cloud accounting and payroll supported by the platform

When a client would like to engage Evershine to provide outsourcing services in accounting, treasury, tax compliance, and payroll management the first requirement would be to use the web-based platform system for internal financial control.

In different languages

We provide the web-based platform in different language versions based on different native language areas.

The currently available versions include Traditional Chinese, Simplified Chinese and Francese.

We can also provide the following versions (upon request): Russian, Spanish with English, French with English, German with English and Arabic with English.

The accounting, treasury, taxation, and payroll tasks were made much easier and more flexible for qualified persons when clients adopt this web-based platform.

These functions can be undertaken by the staff of the subsidiary, staff of the parent company, Evershine staff, or staff of an engaged certified tax accounting firm.

Collaboration among staff in the subsidiary, parent company and Evershine

Evershine only provides a web-based platform system designed exclusively.

All functions for accounting, treasury, taxation and payroll management would be undertaken by staff of the subsidiary or staff of the parent company. Clients will execute their business processes through the web-based platform system provided by Evershine.

Evershine will teach the client’s staff how to use our web platform system which is stationed in the Chung-Hua Telecommunication Internet Data Center. Clients do not need to invest any more money in computer servers or software.

Client staff users only need to be allowed to access the Internet.

If your subsidiary does not want to recruit any staff per accounting function and payroll management, you can engage Evershine to do this on your behalf.

If a client has a staff recruiting problem when setting up a new cross-region operation they can assign Evershine staff to undertake this task.

Local partner arranged by Evershine CPAs Firm

In Taiwan, the client service team would be staff assigned by Evershine CPAs Firm, Evershine BPO Service Corp, Xiamen Evershine BPO Service Company and certified tax accounting firms located near your subsidiary.

In other countries like France, Paris, etc, the service team would be staff assigned by Evershine BPO Service Corp and an IAPA member located near your base of operation.

Seamless Collaboration

Seamless Collaboration, Please firstly click Collaboration Diagram

Our web-platform allows authorized employees of your Asia subsidiary, parent company, and Evershine to do accounting in the way of seamless collaboration.

Once anyone keys-in/ updates information, authorized parties can access, query, and obtain said information immediately.

We provide different outsourcing service models. Clients can change and adjust these models to fit their needs.

In addition, our services would allow you to be seamlessly transferred when necessary.

The clients generally engage us for two kinds of purposes:

The first one is to relieve a staff recruiting problem for their financial accountant when setting up a cross-region operation in Taiwan, China or other Asian cities.

The second one is to reduce fraud risk in a subsidiary operation in these cities through collaboratively joining a daily authorization program run by the parent company staff.

We provide different comprehensive outsourcing services in financial accounting and payroll management:

With the web-based financial accounting platform designed by Evershine and a web-based banking authorization system provided by the clients’ local domestic bank,

Evershine provides different comprehensive outsourcing services in financial accounting and payroll management.

The most comprehensive one is the “total outsourced model”

You do not need to recruit any staff relevant to accounting, treasury, payroll management, tax compliance, and IT functions. Simply outsource all the above-mentioned functions to Evershine.

Another one is the “collaboration model”

Evershine staff and your staff in the subsidiary or parent company would collaborate to undertake the accounting, treasury, payroll management, tax compliance, and IT function.

Lastly, we also provide the “ITO only model”

Evershine only provides the web-based financial accounting platform plus an online preview to each form approval process.

Your staff in the subsidiary or parent company would undertake all collaborative functions.

You can alternate among the “total outsourced model”, “collaboration model”, and the “ ITO only model”

This means that in order to meet the change in your business environment, including organization or scaling of staff number, you can easily adjust from the various outsourcing services expanding or reducing the model in order to use only the ones that apply to you.

Evershine can assist your subsidiary operation in Taiwan, China, and other cities:

If you adopt the above-mentioned “total outsourced model”, our service items would include the following:

Accounting Outsourcing

Payroll Compliance

Taxation Compliance

Setup of Subsidiary, Branch or Rep Office.

Effective control through our featured services such as:

Through the web-based collaborative platform developed by Evershine.

Able to review accounts, bills, and business documents anywhere, anytime!

Able to review financial reports anywhere, anytime!

Secure online approval and audit processes

Compliant with international accounting standards.

Fraud-Proof Practice

Traditional paying authorization processes in China refer to the above “Big Chop” and “Small Chop”, and those authorized to use these two chops are entitled to the full withdrawal of all sums from your corporate bank accounts.

More than 85% of China WFOEs encountered fraud pay-out issues in 2009, according to surveys (Please refer to Asia-Pacific Fraud report).

Frauds have become a great concern for Chinese WFOE Enterprises, which usually involve cash larceny, cash skimming, inventory larceny, conflicts of interest, bribery, etc.

Amongst these were several fraud cases with which no tracks of the fraud personnel could be found due to the usage of the Big Chop and Small Chop, which leaves no trace of the individual’s name on the banking withdrawal documents.

Hence fraud risk management is imperative when establishing operations in China.

Adopting Evershine services enables you to safeguard your bank account for authorized pay-outs only.

Necessary internal controls have been built into our web-platform, and wiring to vendors or employees through our secured web-banking involves a 3-step authorization process rather than using the traditional Big Chop and Small Chop.

The approval processes are managed at the parent company, and no individual parties can tamper with real cash in your bank account.

No in-house accountant or cashier is needed when applying our Total Outsourcing Model.

Our service greatly reduces the risk of fraud via in-built internal controls into our web-platform compliant to 404 compliance procedures.

For example, all vendors and employees need to be approved through authorization processes.

All payment processes (save small petty cash) must go through the web-banking 3-step authorization process before being directly wired to an individual vendor or employee.

In addition, all salary is directly wired to confirmed individual employees’ bank accounts only, in order to prevent the existence of ghost accounts or phantom employees.

For an entity with inventory, we periodically arrange physical inventory in your subsidiary, branch, or joint venture.

Global Wise Organized Service items and Packages include:

Company set-up (symbolized as ELR),

Initializing your Business (ELI)

Special Industry Permit Application (ELS)

Work Permit and Resident Certificate Application (ELW)

Payroll Processing and compliance (ELP),

Expenses processing and its withholding tax compliance (ELE),

Business Processing Operation services (BPO) by the industry as below:

**Trading industry: Selling-Purchasing-Inventory Cycle (ELB)

** Project-based industry: Selling-Purchasing cycle (PJT)

**Electronic Commercial Business (ECB)

**Retailing Industry (RTL)

**General Service industry (SVC)

**Electronic Commercial Service industry (ECS)

**Cost-plus Charge services (CPC)

VAT processing and compliance (ELV);

General Ledger Accounting and corporate income Tax compliance (GLA)

Annual Statutory Auditing and Tax-purpose auditing (ELY)

Other Miscellaneous Services (ELM)

Stock-listing Consulting Services(ELC)

Time-shared CFO services (ELC-CFO).

**

In Paris, when clients require, the statutory auditing services will be provided by IAPA members in Paris.

Global Wise Organized Service Items and Packages please click it to get detailed information

Country-by-country online Knowledge Database:

We have built County-by-country online Knowledge Database based on Main Topics

The Main Topics are relevant to those must-know issues when a Multi-National-Entity (MNC) expands overseas entities.

We use County-by-country online Knowledge Database to share and train Evershine staff and local partner staff.

It really is helpful for assuring our clients being compliance with tax, payroll, and investment regulations in each country.

Country-by-Country Online Knowledge Database please click it to get detailed information

Contact Us

If you are interested in knowing more about our cloud services,

please send an email with your requirements to HQ4par@evershinecpa.com

Expect a response within 2 working days.

For investment structure relevant with multi-national tax planning and after-setup Accounting Cashiering Tax Payroll Services,

Please send an email to dalechen@evershinecpa.com & contact Dale Chen, Principal Partner/CPA in Taiwan+China+UK, AIA, & over-all responsible for these arrangements.

linkedin address: Dale Chen Linkedin

Additional Information

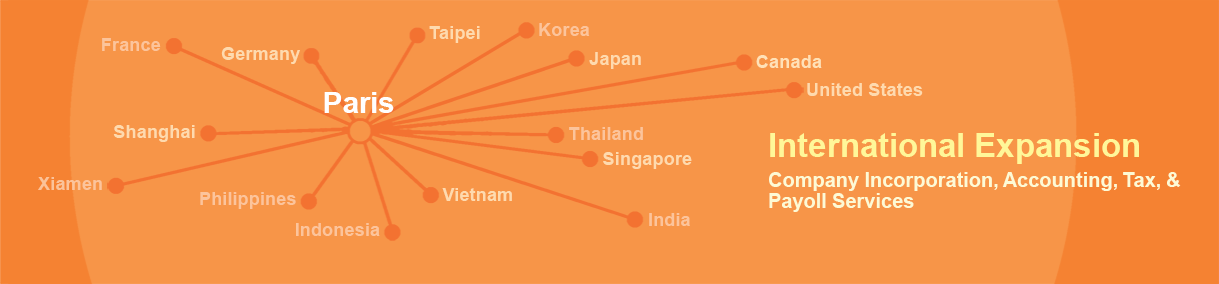

Evershine has 100% affiliates in the following cities:

Headquarter, Taipei, Xiamen, Beijing, Shanghai, Shanghai,

Shenzhen, New York, San Francisco, Houston, Phoenix Tokyo,

Seoul, Hanoi, Ho Chi Minh, Bangkok, Singapore, Kuala Lumpur,

Manila, Dubai, New Delhi, Mumbai, Dhaka, Jakarta, Frankfurt,

Paris, London, Amsterdam, Milan, Barcelona, Bucharest,

Melbourne, Sydney, Toronto, Mexico

Other cities with existent clients:

Miami, Atlanta, Oklahoma, Michigan, Seattle, Delaware;

Berlin, Stuttgart; Prague; Czech Republic; Bangalore; Surabaya;

Kaohsiung, Hong Kong, Shenzhen, Donguan, Guangzhou, Qingyuan, Yongkang, Hangzhou, Suzhou, Kunshan, Nanjing, Chongqing, Xuchang, Qingdao, Tianjin.

Evershine Potential Serviceable City (2 months preparatory period):

Evershine CPAs Firm is an IAPA member firm headquartered in London, with 300 member offices worldwide and approximately 10,000 employees.

Evershine CPAs Firm is a LEA member headquartered in Chicago, USA, it has 600 member offices worldwide and employs approximately 28,000 people.

Besides, Evershine is Taiwan local Partner of ADP Streamline ®.

(version: 2024/07)

Please contact us through HQ4par@evershinecpa.com

For more services in more cities please click Sitemap